This article is written by our intern Dylon Koh, who was a police officer with the Singapore Police Force during his National Service.

"Do not spend my money, let me use it on some fake celebrity instead."

“I’ve never met him, but I trust him!” These were the astonishing words of a complainant (Miss A), who came to my police station to file a report. Miss A, having transferred over her life savings to a ‘Chinese celebrity,’ was one of many unsuspecting victims of an e-commerce scam. Despite my relentless advice, she refused to barge and chose to believe someone she had never met, over a real police officer, me. Did the above appalling statement by Miss A sound familiar to you? Were you, or your family and friends also victims of such scams?

In Miss A’s case, she was adamant that she had been communicating with a real celebrity. She was genuinely convinced that her parcel containing gold bars — a promise too tempting to resist — was detained at France's customs and that remitting a fee of SGD$10 000 was the only way to facilitate its release. But why? Why do people like Miss A fall for scams? Some may feel that it is obvious, since our government, schools, and television painstakingly advocating against scams.

Many youths who supposedly know better, admittedly myself included, begin to question: I am so young and IT-savvy, I know how to tell what’s real and fake. Yet, about 8700 Youths aged up to 29, were scammed.

Who falls for scams?

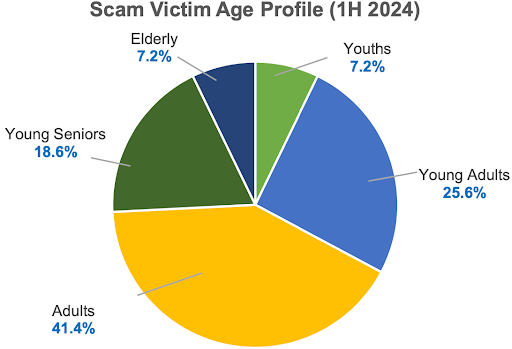

When a survey was conducted by the Ministry of Communications and Information in 2023 about how confident people were about identifying scams on messaging platforms, 67% of those aged 15 to 29 said they were moderately or extremely confident. But in reality, young people are not that scam-savvy. According to the police’s mid-year scam statistics released in September 2024, many scam victims are young people, with about 33% aged 19 to 29, and about 41% aged 30-49. I, too, have received scam calls and messages and mistaken them as legitimate. This is telling. People of all ages fall for scams.

But why do people, ranging from young adults like me to the elderly fall for scams?

Why do people fall for scams?

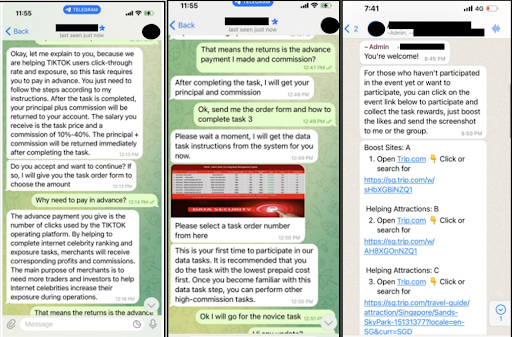

Let’s explore why so many unsuspecting victims like Miss A and 8700 youths (in the first half of 2024) fell victim to scams. One of the main factors is the financial turmoil and desperation for fast cash. The promised reward is too enticing to reject, resulting in victims not thinking twice to consider its red flags and warning signs. You're more likely to fall for a scam when you are in financial trouble, as it can muddle your thinking; especially if it promises a solution to eliminate financial woes. During my stint as a Police Officer, countless young people lodged police reports on job scams, saying things like “I am so stupid… I really thought I would not get scammed…”. Many youths have trouble finding a proper job and resort to ‘fast-cash’ jobs, as shown in the pictures below. And just like the 5717 individuals who lost a total of 86 million dollars in the first quarter of 2024, they got scammed. These mistakes that they have made may seem very obvious in hindsight. Yet, it is a lot more ambiguous in real time. Furthermore, many of us will choose to think we will not get scammed, causing us to make unwise decisions.

- Screenshots of recruitment message and tasks (Singapore Police Force, 2024)

Depression and/or social isolation are also alarming causes of victims falling for scams. Many victims (especially the elderly) live alone and lack support from family members, some even do not have any. Therefore, they feel supported when even the slightest attention is given to them. Scammers exploit this by impersonating friends or people willing to befriend them, deceiving and manipulating how they think, causing them to give more and more money. This is exacerbated by fear and urgency techniques – making it seem urgent for the elderly to pay more to get the supposed promised returns. Elderly, aged 65 and above made up 7.2% of scam victims. Most fell prey to ‘fake friend call’ scams, followed by investment scams. Though the elderly make up one of the smallest age groups of scam victims, as shown in the chart below, the average amount lost per elderly victim is still the highest when compared to victims of the other age groups. This is alarming, as entire life savings are lost without the ability to recover financially. In fact, many worried children approached my Neighbourhood Police Centre (NPC)’s counter with their elderly parents to report that their parents fell for scams and lost up to 30k at once. Scammers exploit victims’ emotions so cunningly that people often find themselves deceived before they even realise what’s happening.

- Scam Victim Age Profile in 1H of 2024 (Singapore Police Force, 2024)

Since the dawn of the digital age, technology has become ubiquitous, exposing everyone to the internet. This widespread influence of technology and rise in internet usage make more people inevitably fall victim to scams.

However, the surge in technology adoption was not accompanied by a corresponding increase in knowledge and awareness of how to use it effectively and safely. This knowledge gap was evident in 2021 when the OCBC phishing scam led to a loss of $13.7 million from over 700 victims. Because users did not fully understand the risks associated with sharing data or engaging with unfamiliar links and messages, their chances of being scammed were high.

Scammers use scheming techniques to deceive victims, so remember that: It is not entirely your fault. The psychology of manipulation is just too real.

What our partners (govt/banks/police) are doing to address this issue?

The Police

Anti Scam Command (ASC), by the Singapore Police Force (SPF) was formed in March 2022 to combat the rising scam numbers. The ASC works painstakingly to investigate scams by linking up directly with stakeholders like banks to freeze fraudulent accounts swiftly.

On the public-facing side, as a Ground Response Force Officer during my National Service, I was at the forefront of promoting anti-scam practices to members of the public. It was heart-wrenching to see countless youths, adults and the elderly approaching my NPC’s counter with a glum face, to reveal that they have lost part of, or even their life savings. Many also felt anger as they had lost their life savings, and could not do anything to recover it. As much as I felt empathetic for their situation and understandably some anger with their tone towards us, all I could do was lodge a report for them, provide them with Crime Prevention Advice, and hope for the best.

The Banks

DBS Bank’s Behavioural Science Team has been researching and analysing scam tactics to understand how human biases and vulnerabilities are being exploited. Cognitive breaks (purposeful pauses when using Online Banking Services) were introduced to shift customers from a “hot” and impulsive state to a “cold” state of calm reflection. Such pauses allow users to re-think their actions and reflect on whether their transactions could be scams.

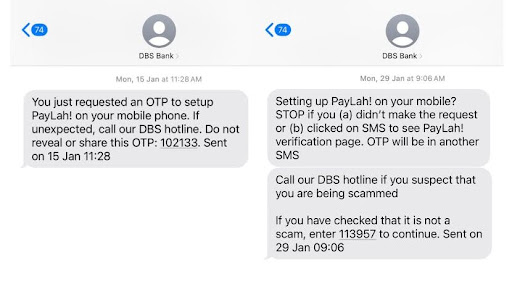

Moreover, two-part text messages were sent to users when they set up PayLah – a capitalised “STOP” followed by a warning to users about scams after a while, allowing users to review their request (shown below). When I was 16 and applied for my first Debit Card, there were no such SMS warnings or much publicity about scams. All I recalled was the prominent “Don’t Panic, Don’t Believe, Don’t Give” tagline used in 2016 to advocate for scams. Today, we are endowed with an array of such reminders, even within our banking apps. Banks continue to work hard to prevent potential victims from becoming real ones.

- A comparison of the old (left) and new (right) styles of texting by DBS to induce a cognitive break for users (Development Bank of Singapore, 2024)

The Government

GovTech, together with SPF and the National Crime Prevention Council have also introduced ScamShield, an app which blocks scam calls and flags likely-scam text messages. After downloading the app, I have noticed a significant decrease in the number of SMSes and unknown calls which may have compromised my personal information. Though I had my reservations when downloading the app as it could access my private network, I realised that network access was required to filter the unknown calls and messages. Besides this app, the 1799 hotline was also introduced by the same 3 agencies to provide scam victims with all the support they need. Potential or victims can call that hotline if they have been scammed to get direct support, or if they have any enquiries

We are also responsible for all this!

Other than putting the responsibility on everyone else, let me invite you to ponder this: We too, have a part to play in this. The fact is this: 86% of scams reported in the first half of 2024 involved victims transferring their own money to unknown people, and doing so willingly. As we feel bad for the victims who may have lost their life savings, we must not forget the role we play as online users. We play a part in identifying scams.

My advice would always be to first think: If I am going to gain something too good to be true, it probably is. Be it high-return investments, cheap concert tickets or products. It would not make sense if we did not have to work for money. Never forget that anyone, myself included, could be a victim of scams.

As Youths, we play an important role in advocating for scam prevention. After all, we are the future of our nation. Here are 3 things we as youths can do to help with combating scams.

- Talk to our friends and family about scams

Casual conversations with friends and family about recent scam trends and precautions are more useful than we think. Knowing recent scam trends makes us more cautious when dealing with likely-scam messages. Having such family support can help prevent scams, as we are all looking out for one another. Remember, one reason people fall for scams is due to the lack of support from their family.

- Engage younger audience on social media

Leverage the influence of social media creators to advocate against scams. As a young person, I understand that traditional messaging from older celebrities or formal agencies doesn’t always resonate with our generation, it can feel distant or less engaging. That’s why younger, relatable content creators are in a great position to carry the message forward in ways that truly connect with their peers.

Check out our Safer Internet Day Skit 2025 – a project created by young people, for young people.

- Adopt useful technology to aid us in this battle

Download the Scam Shield App to block scam calls and texts. Join ScamShield’s Telegram and WhatsApp Channels to keep yourself updated on the latest scam trends. Lastly, you can keep updated with any news from the Police on SPF’s Website, and share such news with your friends and family.

The truth…

In essence, the psychology of scams is just too real, so do not blame yourself for making a mistake that anyone could have made. Trust that the authorities are trying their best to fight this seemingly endless fire, and cooperate with them respectfully. Do not forget that as internet users, we too, have a part to play. After all, I am sure none of us wishes to lose even a single cent to a stranger. It is with great hope that you will believe my above explanations, tips and story, even though you have never met me.

If you suspect that you have fallen victim to a scam, immediately contact your bank to halt any further transactions. Thereafter, visit your nearest Neighbourhood Police Centre to lodge a report or do so online via SPF’s e-Services.

~ Your Friendly ex-Police Officer

References

- Tan, C. (2024, November 14). Young people say in MCI survey they can identify scams, but police crime statistics show otherwise. The Straits Times. https://www.straitstimes.com/singapore/courts-crime/young-people-say-in-mci-survey-they-can-identify-scams-but-police-crime-statistics-show-otherwise

- Singapore Police Force, (2024, August 21). Mid-Year Scams and Cybercrime Brief 2024 (Page 14) https://www.police.gov.sg/-/media/B560DF9AB68441A0B5AEAEEEF9ADCB6A.ashx

- Singapore Police Force, (2024, August 21). Mid-Year Scams and Cybercrime Brief 2024 (Page 5) https://www.police.gov.sg/-/media/B560DF9AB68441A0B5AEAEEEF9ADCB6A.ashx

- MSEd, K. C. (2024, September 17). There's a Reason Even The Smartest People Fall For Scams. Verywell Mind. https://www.verywellmind.com/why-we-fall-for-scams-8705528

- Police advisory on job scams. (2024, Feb 20). Singapore Police Force. https://www.police.gov.sg/media-room/news/20240220_police_advisory_on_job_scams#:~:text=The%20Police%20would%20like%20to,as%20boosting%20products%20on%20e%2D

- Police advisory on job scams. (2024, Feb 20). Singapore Police Force. (Page 15) https://www.police.gov.sg/media-room/news/20240220_police_advisory_on_job_scams#:~:text=The%20Police%20would%20like%20to,as%20boosting%20products%20on%20e%2D

- New anti-scam helpline from Monday to tackle rise in scams. (2016, November 20). The Straits Times.https://www.straitstimes.com/singapore/new-anti-scam-helpline-from-monday-to-tackle-rise-in-scams

- Brand Studio. (2025b, February 4). Behind the scenes of DBS’ anti-scam efforts. CNA. https://www.channelnewsasia.com/advertorial/behind-scenes-dbs-anti-scam-efforts-4722216

- Brand Studio. (2025, February 4). Behind the scenes of DBS’ anti-scam efforts. CNA. https://www.channelnewsasia.com/advertorial/behind-scenes-dbs-anti-scam-efforts-4722216